While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Therefore, you need to deduct the amount of these cheques from your bank balance. It is important to note that it takes a few days for the bank to clear the cheques. This is especially common in cases where the cheque is deposited at a bank branch other than the one at which your account is maintained. Therefore, such adjustment procedures help in determining the balance as per the bank that goes into the balance sheet.

Adjust the Bank Statements

As a result, the balance as per the bank statement is lower than the balance as per the cash book. Such a difference needs to be adjusted in your cash book before preparing the bank reconciliation statement. Incorrectly recording transactions in the accounting system can result in errors in the balance sheet and bank statement, making it challenging to reconcile. Ensure that the income and expenses on the balance sheet match the bank statements to identify any unaccounted expenses or deposits.

How We Make Money

Connect QuickBooks to your bank, credit cards, PayPal, Square, and more1 and we’ll import your transactions for you. When you receive your bank statement or account statement at the end of the month, you’ll only spend a minute or two reconciling your accounts. QuickBooks organizes your data for you, making bank reconciliation easy. In general, reconciling bank statements can help you identify any unusual transactions that might be caused by fraud or accounting errors. As you know, the balances in asset accounts are increased with a debit entry.

Bank Reconciliation Problems

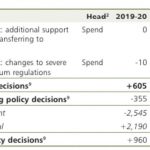

In this case, businesses estimate the amount that should be in the accounts based on previous account activity levels. The bank statement and the company’s records now both show a $6,975 balance. 10% of all occupational fraud cases in small businesses are due to bank account reconciliation errors.

The four basic steps involved in the bank reconciliation process are described below. Service charges may be levied by the bank for regular or special services. They often appear as a reconciling item because banks notify customers of the amount only through the bank statement. Once the balances are equal, businesses need to prepare journal entries for the adjustments to the balance per books. This is an important fact because it brings out the status of the bank reconciliation statement. In the case of items in transit, these arise from several circumstances.

Check for other transactions

You have to go back and compare your records with the bank’s to try and figure out what went wrong so you can correct your records to match the banks. Check your ledger’s recorded deposits, withdrawals and cleared checks against those listed on the bank statement. Everything listed on the bank statement should be included in your records and vice versa. Bank reconciliation statements are tools companies and accountants use to detect errors, omissions, and fraud in a financial account.

This is done to confirm every item is accounted for and the ending balances match. To do this, businesses need to take into account the bank charges, NSF checks and errors in accounting. Deposits in transit are amounts https://www.quickbooks-payroll.org/ that are received and recorded by the business but are not yet recorded by the bank. (c) A deposit of $5,000 received by the bank (and entered in the bank statement) on 28 May does not appear in the cash book.

Outstanding checks are those that have been written and recorded in cash account of the business but have not yet cleared the bank account. This often happens when the checks are written in the last few days of the month. They are helpful bookkeeper when reconciling accounts to print statements, clearing errors, etc. They can also be helpful when reconciling accounts for pulling reports.Another example would be where you deposit cash, but the teller doesn’t post it correctly.

After you reconcile, you can select Display to view the Reconciliation report or Print to print it. Before you start with reconciliation, make sure to back up your company file. Cash management software can integrate with many data sources, ensuring consistency in data requirements and quality.

- When you reconcile, you compare your bank statement to what’s in QuickBooks for a specific period of time.

- The bank reconciliation also provides a way to detect potential errors in the bank’s records.

- As a result, the bank debits the amount against such dishonored cheques or bills of exchange to your bank account.

- Get granular visibility into your accounting process to take full control all the way from transaction recording to financial reporting.

- For instance, a company will have one Cash account for its main checking account, a second Cash account for its payroll checking account, and so on.

- Adjust your records to match the bank statement, considering deposits, withdrawals, fees, and errors.

This is often done at the end of every month, weekly and even at the end of each day by businesses that have a large number of transactions. Match the deposits in the business records with those in the bank statement. The bank https://www.business-accounting.net/sole-proprietorship/ explains the difference between the balance in the company’s records and the balance in the bank’s records.

Non-sufficient funds (NSF) checks are recorded as an adjusted book-balance line item on the bank reconciliation statement. For example, say ABC Holding Co. recorded an ending balance of $500,000 on its records. After careful investigation, ABC Holding found that a vendor’s check for $20,000 hadn’t been presented to the bank. It also missed two $25 fees for service charges and non-sufficient funds (NSF) checks during the month. In addition to this, the interest or dividends earned on investments is directly deposited into your bank account after a specific period of time.