One of the most crucial aspects of running a business is bookkeeping, an accounting process that entails the recording of financial data and transactions. Some bookkeeping services can provide a full suite of bookkeeping, accounting and tax services. Examples include bookkeeping journal entries, bookkeeping ledger, bookkeeping reconciliation charles kurk professional bookkeeping services and bookkeeping trial balance. Bookkeeper360 integrates with third-party tools, such as Bill, Gusto, Stripe, Shopify, Xero, Brex, Square, Divvy and ADP. These integrations make it easy to track your bookkeeping and accounting data in one place. It also offers full-service bookkeeping, meaning that its team will do the bookkeeping for you.

Advance your career with an online degree

Because of these factors, advancing your bookkeeping career to a role in accounting can be advantageous. For instance, the job outlook for accountants and auditors has a 6 percent growth rate from 2021 to 2031. The median salary for these roles is also higher than for bookkeepers at $77,250 per year [4]. Financial institutions, investors, and the government need accurate bookkeeping accounting to make better lending and investing decisions. Bookkeeping accuracy and reliability are essential for businesses to succeed for staff, executives, customers, and partners. Data entry involves entering your business’s transactions into your bookkeeping system.

Bookkeeping Options for Small Business Owners

- Keep an organization’s financial data confidential and be transparent about your bookkeeping activities.

- With our user-friendly platform and growing bookkeeping, tax, and accounting professional network, we’re here to make your search for the perfect match smoother and more efficient.

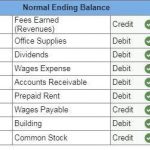

- The two key reports that bookkeepers provide are the balance sheet and the income statement.

- And if you want straightforward finance tracking without in-depth analytics, Wave Accounting can help you with the basics.

- Even if you aren’t planning on growing any time soon, you need to have a sense of how much money is coming in vs. what is going out.

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Cassie is a deputy editor collaborating with teams around the world while living in the beautiful hills of Kentucky. Prior to joining the team at Forbes Advisor, Cassie was a content operations manager and copywriting manager. One of the best things you can do to ensure your books balance properly is to follow the three golden bookkeeping rules.

Zoho Books: Best invoices

Oracle NetSuite and FreshBooks are two other popular bookkeeper software options. If you’re nervous about setting up accounting software for the first time, Kashoo’s experts can talk you through it. So while Kashoo isn’t as comprehensive as competitors like QuickBooks, Xero, and FreshBooks, its customer service reputation is a definite point in its favor. Because bookkeeping involves the creation of financial reports, you will have access to information that provides accurate indicators of measurable success.

Track Absolutely Everything

The questions and examples are real and provide you a moment to do some critical thinking. We asked all learners to give feedback on our instructors based on the quality of their teaching style. Every transaction you make needs to be categorized and entered into your books. The IRS also has pretty stringent recordkeeping requirements for any deductions you claim, so having your books in order can remove a huge layer of stress if you ever get audited.

What accounting software do bookkeepers use?

A small business can likely do all its own bookkeeping using accounting software. Many of the operations are automated in the software, making it easy to get accurate debits and credits entered. Do you have more questions about the bookkeeping process for small businesses? Wondering how best to collect and track financial information, deal with expense management, and ensure healthy cash flow for your business? Here are some of the most frequently asked questions on bookkeeping for small businesses. It might feel daunting at first, but the sooner you get a handle on this important step, the sooner you’ll feel secure in your business’s finances.

Without basic bookkeeping practices, it’s easy for financial transactions and spending activities to get out of control, which can lead to confusion, disorganization, and loss of profit. AccountingDepartment.com offers customized bookkeeping services to businesses having a yearly revenue between $2 Million to $100+ Million. You can earn certification from the National Association of Certified Public Bookkeepers (NACPB) and the American Institute of Professional Bookkeepers (AIPB). The NACPB offers a certified public bookkeeper (CPB) certification, while the CPB offers a certified bookkeeper (CB) certification. Both the CPB and CB certifications require similar eligibility requirements.

Bank accounts allow businesses to safely store their money and make transactions easily. There are several types of business bank accounts, each with its own purpose and benefits. An accounting ledger is a book or system you use for recording and classifying financial transactions. For every new small business, it might not make sense to hire a bookkeeper straight away.

It also includes more advanced tasks such as the preparation of yearly statements, required quarterly reporting and tax materials. QuickBooks Online users can choose QuickBooks Live Bookkeeping to get year-round access to verified experts who are focused on their success. From the start, business owners can get personalized answers to questions and spend less time on their books. A bookkeeping checklist outlines the tasks and responsibilities you need to do regularly to keep the books up-to-date and accurate. It serves as a road map to ensure you correctly record and report all necessary financial transactions are recorded and reported correctly.

With so many moving pieces (including assets and liabilities, and income and expenses), small business owners must stay on top of it all. Despite the importance of accurate bookkeeping practices, most people don’t feel entirely confident with maintaining detailed business finances. Whether it’s a lack of interest or knowledge, many businesses outsource this process to a professional bookkeeper to ensure accurate and healthy finances all around. Bookkeeping is how businesses, entrepreneurs, and decision-makers monitor a company’s overall financial health and activity.

These services are a cost-effective way to tackle the day-to-day bookkeeping so that business owners can focus on what they do best, operating the business. For business owners who don’t mind doing the data entry, accounting software helps to simplify the process. You no longer need to worry about entering the double-entry data into two accounts. https://www.adprun.net/ We reviewed multiple accounting software options using a detailed methodology to help you find the 9 best online bookkeeping services for small businesses. Our ratings considered everything from pricing and customer reviews to the number and quality of features available and what our panel of experts thought about the services available.

Accrual accounting provides a more accurate picture of a business’s financial health than cash accounting, as it considers all of the financial transactions for a given period. This accounting method is useful for businesses with inventory or accounts payable and receivable. Forbes Advisor analyzed 13 online bookkeeping services and considered 15 metrics such as price, features, customer service, https://www.quick-bookkeeping.net/accounting-for-loans-receivable/ ease of use, integrations and service level. We also looked at real customer experiences to determine if their expectations were met based on what each company promised. After assigning a weighted score to each category, we formulated rankings for each company. Using the data you gain from keeping a ledger, your next step will be to generate and prepare financial reports for analysis.