Are you thinking exactly how house finance performs? Possibly you happen to be function your mind towards the to order an article of house you to definitely wondrously fits your following family? Getting that loan getting homes are a sensible circulate, particularly when you will not feel constructing your residence right away.

Procuring land money is a wonderful means to fix help make your pick promptly. You could pull out a mortgage for belongings exactly the same way you would for a property-the only improvement and you may trouble ‘s the land’s investigations. Land value is more tough to dictate in comparison to a beneficial household.

Why don’t we examine all you need to discover acquiring a secure mortgage, so that your financial support is a straightforward, carefree techniques.

Where Do you Ensure you get your Financing? Financial institutions or specific loan providers will offer your belongings funds. You can look for property lenders because of the asking around, possibly to an agent or doing all of your very own on the web search. Regional borrowing from the bank unions are a great starting point. Usually, regional lenders are a great source for in search of homes financing.

After you’ve discovered your lender of choice, they are going to get to know your credit report, in addition to the land’s market price. Next they will certainly generate a final decision about your eligibility to order you to home.

Remember that the lender have a tendency to check occasionally as well as have in all levels off build

How will you See Residential property Funds? The whole process of getting your homes financing takes multiple versions; the reason being there are many financing items. Yet not, in every residential property buy deals, it might be best to have a good credit rating, good obligations-to-income ratio and you may a continuing earnings.

Home is considered a beneficial riskier financing than just a building. That it supplies one or two effects. Basic, you will have to pay so much more out-of-pocket on the deposit plus the interest.

Next, land funds usually are provided simply for the short term. The fresh new property financial grows more than just a couple of in order to 5 years. If you purchase so it house to construct property, you may get an extended mortgage.

Belongings Financing Types As we discussed earlier, the method having acquiring their land loan is dependent on the latest kind of mortgage you consult. Here are the most common sizes:

Raw Property Mortgage It enforce if you plan to invest in intense land; definition there aren’t any developments otherwise construction inside. There are not any place possibly: no fuel, sewerage, path system, etcetera.

In cases like this, the dangers are the highest for your financial. The chance expands proportionally on time necessary to build new property.

We offer highest interest levels and you will big down-payment conditions. On the raw house mortgage, you will have to hide in order to fifty% of your own count. When you need to improve likelihood of delivering for example a good home loan and also have an effective terms and conditions, you really need to expose the lending company which have an intricate and you may efficient homes development bundle.

Lot-Land Loan This is the appropriate loan should you want to pick a bit of residential property with a certain number of infrastructures, for example gas, liquid and strength. The fresh new land most likely might possibly be employed for construction innovation, which is a better financing for loan providers.

They’ll be more inclined to provide the property mortgage not as much as particularly requirements. The greater increased one lot is, the better chances of getting an area financial. Constantly, this new contract words are certainly more informal too.

The eye pricing is below intense homes money because of reduced risk. We offer brand new down payment criteria to-be from 30-50% off.

Structure Home Mortgage While you are building a home immediately, would certainly be much better presented with a houses loan. Design fund render finance to create our home that up coming roll that over toward a long-term mortgage.

This type is a two-in-you to definitely mortgage. You might get a loan which takes care of both the home we want to pick while the design we would like to produce on this subject house. not, this calls for an effective credit score (more 700), a reduced personal debt-to-income ratio and a leading earnings-therefore the build invention arrangements have to promote real really worth.

In this instance, you continue to keeps a down-payment out of 10-20%. The building arrangements must be install thanks to a professional and you may reputable designer.

You also have to present the specific design timeline as well as the pricing imagine. The lending company could even suggest numerous dependable designers. If you work with her or him, your odds of bringing a homes loan boost more.

They will certainly discovered their money in many pulls over the processes. The draw agenda is actually agreed upon anywhere between you, the financial institution plus the creator.

Such home financial try an initial-label you to-the typical becoming 1 year. In framework period, you’ll pay focus payments; then the mortgage becomes a home mortgage, that have a good fifteen- so you’re able to 29-season term. The home is going to be often modular structure or a traditional stick-built home.

Rates of interest Generally, a myriad of homes money are considered high-risk of those by the one lender. Ergo you can expect in the very start having high-height rates. A beneficial credit history gives you expect better interest rates.

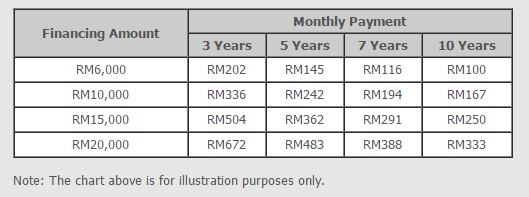

To convey a broad tip, here you will find the average costs for good 10-year mortgage and you may a thirty-12 months financing, respectively:

To have brutal financing: cuatro.25-5.25% / 4.90-5.90% To own package funds: cuatro-5% / cuatro.65-5.65% To have framework fund: varying rates (as much as 5.25%)

Thus, these homes financing is one of difficult to obtain

Selecting the Land You’ve got greatest chance on bringing a land financing for people who keep numerous belongings factors planned:

Boundaries: They have to be well defined. It helps into the establishing this new land-value. Constantly, loan providers will need a secure border questionnaire before carefully deciding for people who qualify or perhaps not.

Restrictions: Lenders need to know in case the home is part of some control contacts or covenants. It comes down having liabilities that they may not be happy to accept.

Utilities: The greater number of, the better for your home and then make a great effect towards the your own lender. They enjoy accessibility paved courses, energy, energy commitment, sewerage. If the a number of them is actually lost, present your own bank which have an intensive plan for incorporating them.

Meant invention: The value of this new targeted homes develops if your whole urban area are around creativity, such as for example when the you’ll find plans to have departmental stores, residential houses, roads, an such like. Establish your own financial each one of these, and you can quickly get your homes loan. Final thoughts Land fund offer a beneficial investment chance for those who would like to get a bit of home to help you at some point either generate the fantasy household otherwise build certain business opportunity. You should have a far greater knowledge of just how residential property fund really works.

Expenses Gassett is a nationally acknowledged a home commander who has come enabling anyone buy and sell MetroWest Massachusetts a property to have going back 33 ages. He has come among the many better Re also/Maximum Real estate professionals within the The fresh The united kingdomt over the past , he was brand new No. 1 Re also/Max realtor in Massachusetts.